how much did you pay in taxes doordash

The IRS does not apply deductions on prizes up to 600. Are a United States citizen or permanent resident Were an unmarried individual in 2020 Had no dependents in 2020 Could not be claimed as a dependent in 2020 Were.

Doordash History And Strategy Deep Podcast Case Studies

A 1099 form differs from a W-2 which is the standard form issued to.

. There are two different. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. No tiers or tax brackets.

Do you pay taxes on. Internal Revenue Service IRS and if required state tax departments. When youre in the highest tax bracket youre paying a marginal.

In some regions we offer DashPassa subscription program that offers a 0 delivery fee and reduced service fees for subscribers when ordering 12 or more from any DashPass-eligible. If you earned more than 600 while working for DoorDash you are required to pay taxes. For the 2022 tax year the standard mileage allowance is 585 cents per mile for the first six months and 625 cents for the second half.

The only real exception is that the Social Security part of your taxes stops once you earn more than 142800 2021 tax year. Then on the 9701-11000 dollars you would need to pay 12 of that. Yes - Just like everyone else youll need to pay taxes.

Solved You will owe income taxes on that money at the regular tax rate. It doesnt apply only to. Do you have to pay DoorDash taxes under 600.

How Much to Pay DoorDash Taxes. If youre self-employed though youre on the hook for both the employee and employer portions bringing your total self-employment tax rate up. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. There isnt a quarterly tax for 1099 Doordash couriers. How much do you pay in taxes for DoorDash.

How Much Tax Do You Pay On Doordash. You still have to pay taxes if you made under 600 and didnt receive a 1099. The forms are filed with the US.

A 1099 form differs from a W-2 which is the standard form issued to. 2 days agoRemember the rest of your federal tax bill comes next year and will cost you another 43603955. A 1099-NEC form summarizes Dashers earnings as independent.

The last time I did self-employed type driving work I took out 20 and that was way too much after mileage deductions I didnt pay much at all. This is a flat rate for gig work so youll pay the same. If you win the Powerball how much do you really receive.

The main exception is if you made under 400 in. There is no fixed rule about this. So when you take the cash option you will end up with 211528045 after.

Additionally you will have to pay a self-employment tax. Since Im only going to do this on the side. It depends on the sum.

5 hours agoThe 5 things you need to know this October 28. That said the rule of thumb is to set aside 30 to 40 of your profits to cover state and federal taxes. While 625 cents may not seem like.

Federal income and self-employment taxes are annual. We file those on or before April 15 or later if the government. Dashers are self-employed so they will pay the 153 self-employment tax on their profit.

This means you will pay a higher tax rate on the income you earn over the threshold for your tax bracket. Dashers pay 153 self-employment tax on profit. However you may now be wondering what the process is for.

You can figure this out by subtracting 11000-9701. 22 hours agoIf you win a smaller Powerball prize do you have to pay taxes. So on the first 9700 dollars you will pay 10 or 970 dollars in taxes.

How Much Do You Pay In Taxes Doordash Reddit Lifescienceglobal Com

How Can I View My Delivery History With Doordash

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

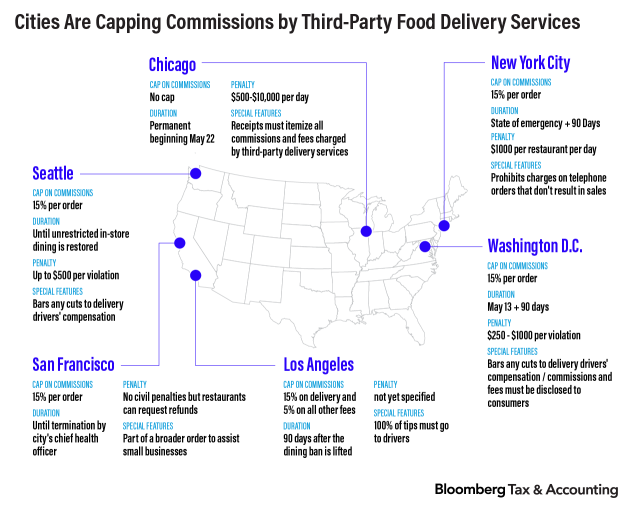

Audit Risks Emerge For Doordash Grubhub And Uber Eats

Doordash Driver Pay After Taxes Is It Worth It 2021 2022 Youtube

/cdn.vox-cdn.com/uploads/chorus_asset/file/22157871/1230032761.jpg)

Doordash Creates Chicago Fee In Response To City S Third Party Cap Eater Chicago

Doordash Taxes Does Doordash Take Out Taxes How They Work

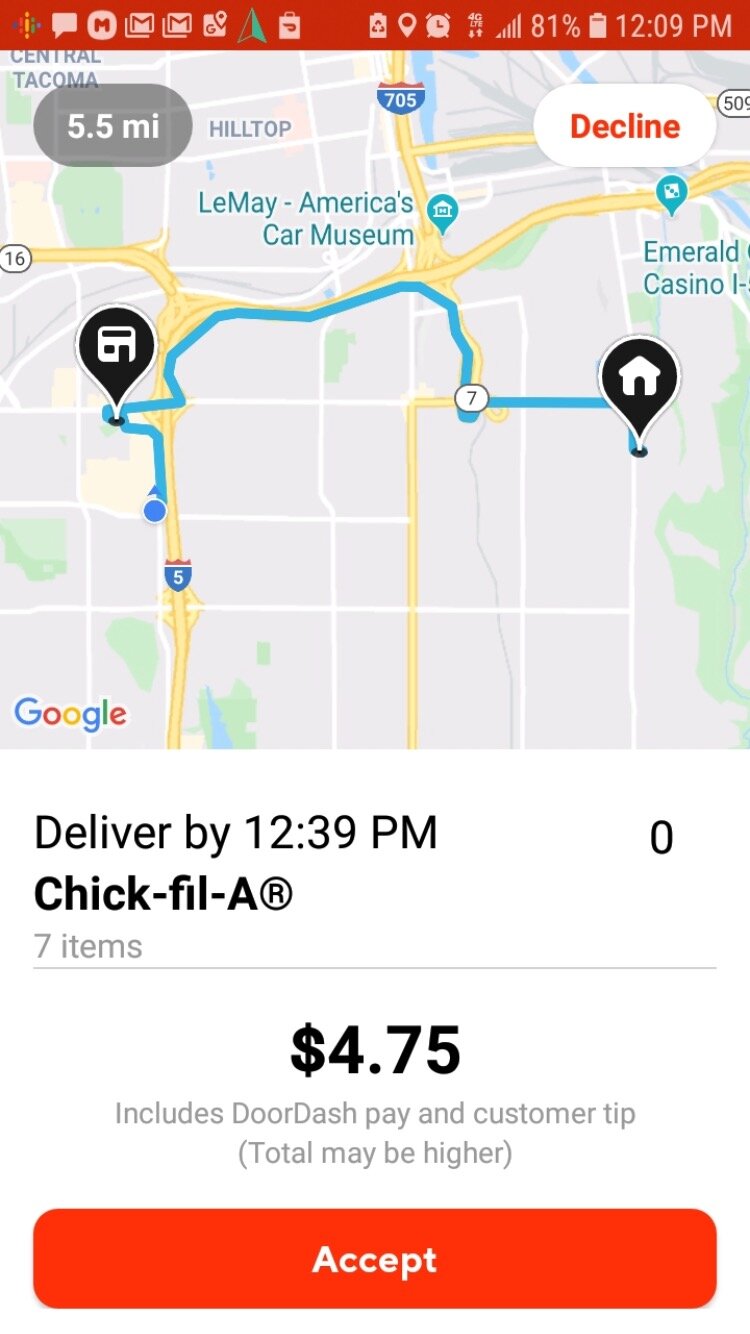

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup

9 Best Tax Deductions For Doordash Drivers In 2022 Everlance

Dasher Pay Breakdown R Doordash

Doordash How It Works Pricing How To Use And More 2022

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup

Doordash Driver Review How Much Money Can You Make

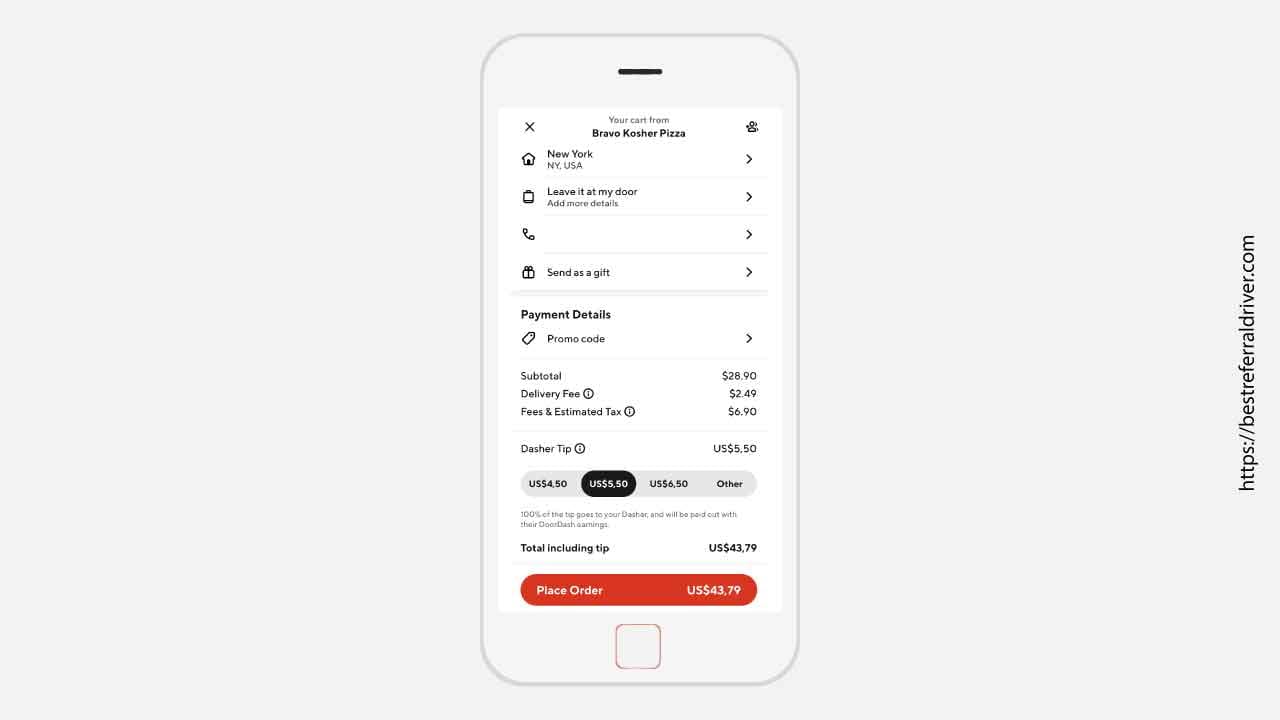

Doordash Fees How Much Does Doordash Cost In 2022

Doordash Fees How Much Does Doordash Cost In 2022

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver